|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

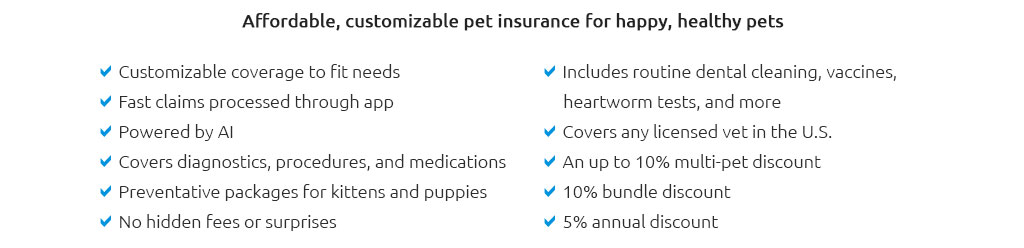

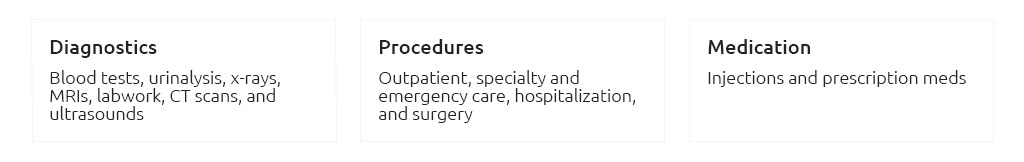

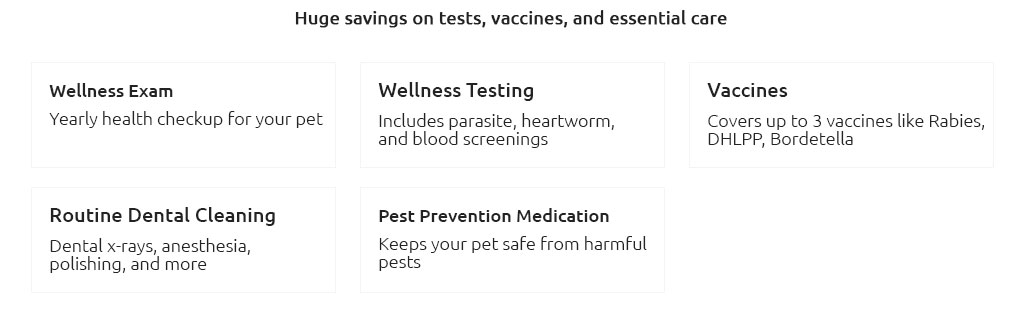

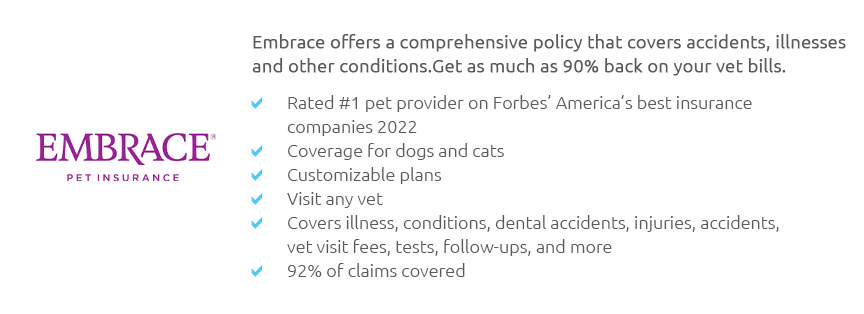

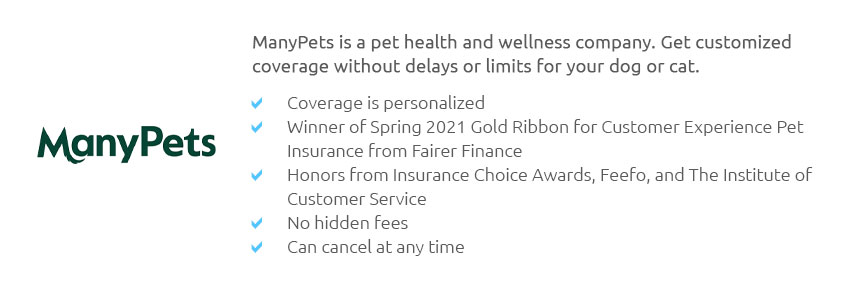

Understanding Dog Insurance: A Comparative GuideIn the ever-evolving world of pet care, dog insurance has emerged as a critical component for many pet owners who want to ensure their furry friends receive the best possible care without the financial strain. With a plethora of options available, choosing the right policy can be daunting. However, by understanding the nuances of different plans, you can make a well-informed decision that suits your dog's needs and your budget. Firstly, it is essential to comprehend what dog insurance typically covers. Most policies offer coverage for accidents and illnesses, which includes a variety of scenarios such as broken bones, ingestion of foreign objects, and chronic illnesses like arthritis or diabetes. Some plans also cover hereditary and congenital conditions, which are crucial for breeds predisposed to specific health issues. However, not all plans are created equal. Some may offer wellness coverage, which includes routine check-ups, vaccinations, and preventative care, while others may not. It is important to scrutinize these differences to ensure you select a plan that aligns with your priorities. When comparing dog insurance policies, several factors demand careful consideration. Premiums are the monthly payments you make to keep the policy active. While lower premiums are attractive, they often come with higher deductibles and co-pays. The deductible is the amount you must pay out-of-pocket before the insurance kicks in. Policies with higher deductibles generally have lower monthly premiums, but they might not be ideal if you're not prepared for significant out-of-pocket expenses. Another key element is the reimbursement level, which refers to the percentage of the vet bill that the insurance company will cover. A typical reimbursement level is between 70% and 90%, but this can vary. As you explore your options, it is advisable to compare several providers. Each company has its own set of terms, and while some might excel in comprehensive coverage, others might offer exceptional customer service or additional perks. For instance, some insurers provide coverage for alternative therapies such as acupuncture or hydrotherapy, which can be beneficial for older dogs or those with chronic pain conditions. Beyond the basic coverage details, it's wise to consider the company's reputation. Reading reviews and testimonials from other pet owners can provide valuable insights into the insurer's reliability and customer service quality. Moreover, understanding the claims process is crucial; a company with a streamlined and efficient claims process can save you a lot of hassle during stressful times. In conclusion, selecting the right dog insurance requires a balance of coverage, cost, and convenience. While it might be tempting to opt for the cheapest plan, ensuring your dog receives comprehensive care often justifies a slightly higher premium. After all, the peace of mind that comes with knowing your pet is protected is invaluable. By taking the time to compare your options thoroughly, you can safeguard your dog's health and your financial well-being. https://www.embracepetinsurance.com/compare

Compare companies based on three key factors: types of coverage, quality of coverage, and coverage customization. https://spotpet.com/compare-pet-insurance

Dive into our comprehensive pet insurance comparison to see how Spot's offerings measure up against other providers. https://www.gocompare.com/pet-insurance/

Compare pet insurance in one search. Plenty of choice. View pet insurance policies from multiple providers in one place.

|